Anti-Trade Alliance

Who’s afraid of globalization? Everybody from Donald Trump to Bernie Sanders, it seems, and environmentalists and factory workers in between. An unlikely coalition of skeptics from across the political spectrum is driving the anti-trade movement.

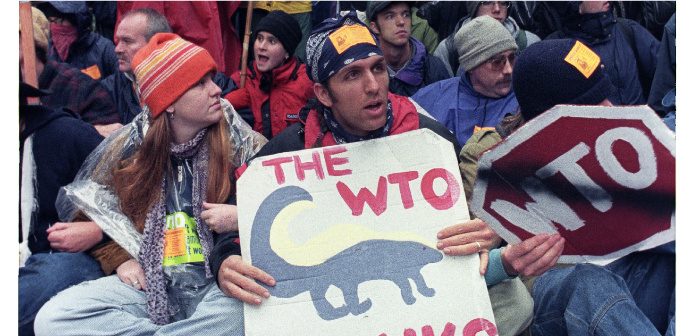

Protesters disrupting a World Trade Organization meeting, Seattle, Nov. 30, 1999. Robert Sorbo

These are bad times for free traders. In the United States, the backlash against trade and globalization was central to Donald Trump’s victory in the 2016 presidential election. His protectionist message found support across America, even as 370 economists, including eight Nobel laureates, signed a letter denouncing Trump’s economic platform. Anti-trade sentiment, also palpable in the 2016 Brexit referendum vote to pull the United Kingdom out of the European Union, appears to be a spreading virus. A 2016 World Trade Organization (WTO) analysis found a trend of increasing protectionist measures around the world.

What accounts for the backlash against free trade? Why is there such a gaping divide between public opinion and economic experts on the issue? Virtually without exception, economists view the free flow of goods and services across borders as the best economic policy for countries at all income levels. In his 1996 book Against the Tide: An Intellectual History of Free Trade, Dartmouth College economist Douglas Irwin writes that free trade is among the strongest policy prescriptions in economists’ arsenal.

The economic case for free trade rests on the argument that free exchange of goods and services will result in higher national income. In other words, if the object of the game is the biggest pie of wealth, then free trade is a means for achieving the goal. This conclusion has its origins in the work of early philosophers Adam Smith and David Ricardo, and volumes of research have confirmed the principle. Countries with fewer barriers to trade clearly outperform those with high barriers on measures of economic growth. By allowing countries to specialize in those goods and services in which they have a “comparative advantage,” liberal trade is a “win-win” for all countries. Because most economists use a growth metric to assess policies, their pro-trade prescriptions follow directly from this metric. Almost by definition, the policy of free trade, which results in the highest economic growth, is the best economic policy.

Opposition to trade is traditionally explained with reference to two groups—those who are harmed (or expect to be harmed) by trade, and those who fail to understand its benefits.

Trade creates winners and losers. In other words, it has distributional consequences. In wealthy Western countries, lower-skilled workers are often harmed by trade liberalization as they face competition from workers in lower-income countries. The signing of the North American Free Trade Agreement (NAFTA) in 1992 and China’s admission to the WTO in 2001, for example, had negative effects on lower-skilled manufacturing workers in the United States.

In developing countries, trade liberalization often creates competitive pressure on local industries when multinationals enter the market with exports or foreign direct investment. Even as a country as a whole becomes richer, particular subgroups will experience adverse consequences. It is natural that these groups will use the political means at their disposal to oppose trade liberalization or to seek protection. This phenomenon was at work in eighteenth-century England when the “groans of the weavers” limited textile imports from India, and it is at work today as the retail industry in India seeks to limit the entry of Western superstores.

Another explanation for opposition to trade has also long been advanced: many simply do not understand the benefits of trade. Harvard University economist N. Gregory Mankiw has proposed a version of the ignorance thesis by suggesting that anti-trade sentiment stemmed from irrational biases.

The Battle of Seattle

Over the past decade, while speaking to a variety of audiences about trade across the United States, I have been continually surprised by the strong anti-trade sentiment I encountered. I have also been struck by how opposition to trade went beyond traditional skeptics such as furloughed workers. In studying this trend, I concluded that four interrelated concerns—about process, sovereignty, risk, and fairness—help explain the recent spread of anti-trade sentiment. In brief, motivated by one or more of these four concerns an unlikely alliance of trade skeptics from across the political spectrum is helping drive the current anti-trade movement.

Concerns about process burst onto the scene in 1999, when anti-globalization demonstrations erupted in dozens of cities around the world, disrupting meetings of a variety of multilateral bodies including the WTO, World Bank, and International Monetary Fund. The so-called “Battle of Seattle” protest succeeded in derailing a WTO ministerial meeting and effectively launching the present-day anti-globalization movement. The failure of the WTO to make much headway in trade liberalization since that time can be traced in part to the popular protests that were a common feature of the landscape during the 1999–2005 period.

Multinational corporations (MNCs) indisputably contribute to economic growth in poor countries. Yet because of perceived links between globalization and exploitation of developing countries, the protests brought new elements into the anti-trade camp: social, labor, and environmental activists. Not coincidentally, the protests roughly coincided with the widespread adoption of the global value chain (GVC) approach by MNCs. This entails slicing up production activities and placing them in different countries through offshoring and outsourcing. Environmental and labor abuses have been publicized in the GVCs of a variety of industries, from apparel to agricultural goods to primary products.

In his 2011 book The Globalization Paradox: Democracy and the Future of the World Economy, Harvard economist Dani Rodrik argues that national sovereignty may be sacrificed under certain kinds of trade liberalization. After the end of World War II, trade liberalization took the form of tariff cuts; indeed average tariffs on imports have fallen by approximately two-thirds since 1980. The trend is particularly pronounced in wealthy countries. For example, average import tariffs in the United States and the United Kingdom are now approximately 2 percent. Especially in wealthy countries, then, further trade liberalization must come from reducing non-tariff barriers, known as NTBs. While tariffs are generally a form of trade protection, NTBs have often arisen outside of trade considerations in the context of a country’s political and policy process. Common NTBs include product safety standards or licensing requirements. NTBs thus serve a purpose beyond their role as trade barriers, and are in place at least in part due to citizen preferences. For example, while the European bans on genetically modified organisms (GMOs) serve as trade barriers that limit imports, the bans are motivated at least in part by national values. Reducing these non-tariff barriers to trade would effectively surrender some political and regulatory self-determination.

Another issue related to sovereignty—and one which the Trump administration has criticized—is the Dispute Settlement Understanding (DSU) agreement under WTO rules. This is a method of trade-related dispute settlement situated beyond the jurisdiction of the judicial systems of member countries. While the intent is to stimulate trade and investment by streamlining dispute settlement, critics argue that in practice the DSU constitutes special treatment for MNCs. Conservative American commentator and former diplomat John Bolton recently argued that the DSU is part of a damaging long-term trend related to trade and other issues that transfers sovereignty from national to international bodies. The retreat from multilateral organizations in the name of sovereignty is central to Trump’s “America First” trade policy.

The economic volatility induced by trade liberalization is another factor explaining the skepticism of citizens who may favor stability over growth. While free trade creates opportunities and income gains, trade flows are more volatile than other components of economic activity. Caroline Freund of the Peterson Institute for International Economics has estimated that world trade dropped nearly five times as much as gross domestic product during the recessions of 1975, 1982, 1991, and 2001. The drop in trade in the 2008 recession was far more dramatic, reflecting the recent widespread adoption of the global value chain model of production. It is likely that the emergence of GVCs amplified the income gains from trade by allowing more efficient distribution of tasks, but at the same time increased the responsiveness of trade flows to economic conditions. While extensive research has documented the income gains from trade liberalization, research evaluating the risk is in its early stages.

Finally, a rallying cry of the past decade or so has been for “fair trade, not free trade.” Significant emerging research in social psychology shows that most people value fairness, and in fact will often give up income gains if they feel they are being unfairly treated. Similarly, people are accepting of losses if they believe the process by which income is allocated is fair. In the realm of trade, the most common concern is focused on various forms of government involvement in economic activity, particularly in countries with strong non-market elements. For example, China’s management of the renminbi was a headline fairness issue for most of the early 2000s, as were Beijing’s state subsidies of a variety of export industries. An undervalued currency and state subsidies can create gains for China’s trading partners by making Chinese exports less expensive. But the attraction of these gains is often swamped by criticism of unfairness. Donald Trump repeatedly raises the fairness issue when discussing trade with China.

The opaque manner in which trade agreements are negotiated also raises doubts about fairness in the minds of many citizens. Since the disruption of the WTO agenda in the early 2000s, many countries have initiated bilateral and multilateral agreements. In the United States, for example, twenty free trade agreements are currently in force, most of these negotiated since the year 2000. Such agreements are normally negotiated in secret, and as a result it is difficult for voters or policy makers outside the discussions to voice concerns or provide input. The resulting suspicion creates concerns about the disproportionate involvement of special interests. Opinion surveys in the United States indicate much more skepticism about trade agreements than about trade itself.

While it would be an overstatement to argue that these four concerns about trade are completely new, it is clear that they have gained force in recent years. What is noteworthy about these sources of skepticism is that they generally arise from disparate groups, with the trade issue often providing the only common ground. It is difficult to imagine policy issues about which President Donald Trump and Senator Bernie Sanders can agree, yet on the issue of trade their policy statements are quite close. Similarly, social and environmental activists have little demographic overlap with furloughed factory workers or populist/nationalist groups, yet their assessments on trade are often similar.

The current headwinds for liberal trade agendas are strong, but it is hard to conceive that the longstanding trend of increasing economic linkages among countries will be reversed. Key forces powering these linkages, especially falling communication and transport costs, are accelerating. Yet given the unlikely alliance of trade skeptics motivated by different factors, advocates of global trade face difficult days ahead. Concerns of workers experiencing layoffs, a traditional pro-protectionist demographic, may be addressed by job retraining and other social protections. But this approach will make less difference to others in the anti-trade alliance such as social and environmental activists. Winning the hearts and minds of voters on trade issues will continue to be a major challenge.

Pietra Rivoli is a professor in the McDonough School of Business at Georgetown University. She is the author of The Travels of a T-Shirt in the Global Economy, which was adapted into a series for NPR’s Planet Money. She has contributed to the Guardian, Financial Times, and New York Times Magazine.