The Prospects for Conflict or Cooperation

Will the Eastern Mediterranean natural gas discoveries lead to regional transformation?

Cypriot President Nicos Anastasiades, Greek Prime Minister Kyriakos Mitsotakis, and Israeli Prime Minister Benjamin Netanyahu before signing a deal to build the EastMed subsea pipeline to carry natural gas from the Eastern Mediterranean to Europe, Athens, Greece, Jan. 2, 2020. Alkis Konstantinidis/Reuters

Tensions are rising in the Eastern Mediterranean. Natural gas discoveries in the waters off Cyprus, Egypt, and Israel, which should be seen as potential energy and economic wins for each country, have instead heightened and deepened regional antagonisms. Underlying rivalries and new forms of competition have led to a potential realignment of power dynamics among the states of the eastern and southern littoral of the sea, from Turkey to Libya to Israel. It will take leadership and luck to transform these energy discoveries into a new form of cooperation among states in the Eastern Mediterranean, potentially leading to new institutional relationships that could treat and end the chronic sources of instability in the area.

The Eastern Mediterranean gas discoveries since 2009 have had the potential to revitalize economic interactions among the states in the region. However, historical and ongoing frictions between Turkey and Greece and the Republic of Cyprus, primarily due to the 1974 division of Cyprus, have diminished the chances for such a salutary outcome. Turkey’s determined attempts to assert its primacy in both the Mediterranean and Middle East also point to competition between two divergent approaches to the energy finds: one under Turkish direction, and another under a broader consortium of stakeholders.

So far, the Eastern Mediterranean has experienced a series of steps and counter steps, some defensive, others provocative, by the key players. Turkey has asserted claims over Cyprus’ Exclusive Economic Zone (EEZ) and has tried to interfere with drilling activities in internationally recognized Cypriot waters. In response, Israel, Egypt, Jordan, Greece, Italy, and the Palestinian Authority created the East Mediterranean Gas Forum, or the EMGF, which convened for the first time in early 2019. European and American companies have become partners with the regional states in exploration activities, adding to the isolation of Turkey, which has responded by creating an exclusive economic zone with Libya, an agreement with an uncertain future given the political turmoil there. This agreement is designed to disrupt future gas developments, including a pipeline from the Eastern Mediterranean through Greece to Italy, and could have particularly adverse effects on Greece.

Regional states and their affiliated private enterprises are hardening their bargaining positions with each passing day, and the uncertainties are impacting other countries. Most recently, Saudi Arabia made its preferences clear when, contrary to past policies, it expressed support for the integrity of the Republic of Cyprus. As competition heats up, Russia and other energy producers can also be expected to take a stand.

These developments highlight the need to understand the new and emerging geopolitical landscape and its consequences. Policymakers are now considering how the key states affected by the energy discoveries are jockeying to reconcile their historic political relationships and rivalries with the prospects for transformation through energy economics. Can the regional states find political and security benefits from the finds, as well as the economic value of energy self-sufficiency and new export opportunities? And how will actors from beyond the region shape the prospects for conflict or cooperation?

The Fields

Major new gas discoveries in the eastern Mediterranean Sea began with the Israeli Tamar (2009) and Leviathan (2010) fields off the coast of Israel. Next came Cyprus’ Aphrodite (2011), Egypt’s Zohr (2015), and the again Cypriot Calypso (2018) fields. This was not the first time maritime gas fields had been discovered in the region, but what made these sites transformative was the scale of the finds. The largest is Zohr with thirty trillion cubic feet of gas, followed by Leviathan with twenty-two, Tamar with eleven, Aphrodite with eight, and Calypso with six to eight trillion cubic feet, respectively. While these are not immense fields compared to those of Russia or Qatar, the prospects for more finds in the East Med and the Nile Basin remain quite high. In fact, the Italian oil giant, ENI, in July 2020 discovered another gas field some eleven kilometers from Egypt’s coastline. Each of the discovered fields contained amounts of natural gas that would satisfy their respective nations’ domestic demand; more importantly, together the sites presented new commercial export opportunities. With global energy demand, especially for natural gas, likely rising again after the coronavirus global shock, gas exports promise to bring in valuable foreign exchange earnings to all three countries.

Beyond the immediate material benefits, these discoveries also have other consequences. First and foremost, the Tamar and Leviathan fields offer Israel, which hitherto relied on imports of coal and oil, what it has always sought: a degree of energy security. The fields also help solidify Israel’s relations with both Jordan and Egypt. Gas exports to both countries have commenced and, in turn, have allowed Egypt to double its liquefied natural gas (LNG) exports to Europe.

These gas discoveries have the additional benefit of helping Europe mitigate its dependence on Russian gas. The European Commission in 2017 argued that “[t]he Eastern Mediterranean is also a promising source of gas supply for the European Union (EU). This increases the diversification opportunities and reduces import dependency on a single supplier, a key objective of the Energy Union.” The Eastern Mediterranean has also piqued the interest of numerous international oil companies from numerous countries. In addition to local companies, others include Noble and ExxonMobil from the United States, Italian ENI, France’s Total, and Qatar Petroleum.

Competing Options for Exporting the Gas

The three gas-producing countries are looking at two major alternative export routes, each facing serious obstacles given Turkey’s objections. The EastMed pipeline would pool Cyprus and Israel’s gas and export it to Europe across a 1,600-kilometer deep-water pipeline that would traverse first to Crete and then through the rest of Greece, landing in Brindisi on the Italian peninsula. This is an ambitious and expensive option, costing approximately $6-7 billion. Although Egypt is not party to this agreement, the possibility that gas from Egypt’s Zohr field will eventually be part of it is real. Nonetheless, in light of the economic setbacks caused by COVID-19, it is unclear whether the investment goals for 2022 will be achievable.

This project has raised other questions, too; some in Europe have argued that Israel’s exports should be directed to regional countries and not Europe, while others have stressed that the EastMed pipeline represents a serious challenge to the Turkish–Russian pipeline, TurkStream. This newly completed pipeline from Russia through the Black Sea to northwestern Turkey would face competition from the EastMed’s added volume and likely lower price.

An alternative or complementary export route is through the two LNG facilities that Egypt operates. The advantage of tanker-shipped LNG is that it is far more flexible than gas transmitted by pipelines, which are more vulnerable to breakdown, political disputes, or even sabotage. If market conditions change, LNG deliveries can be redirected to other markets relatively quickly, thus averting the large investments an undersea pipeline would entail.

But both of these routes face a new challenge: the 2019 Turkey–Libyan maritime agreement with the government in Tripoli. By claiming an EEZ, the Turks and Libyans can effectively split the Mediterranean into two maritime zones with the explicit Turkish intention of preventing the construction of the EastMed pipeline and also the transit of LNG tankers.

The 1982 United Nations Convention on the Law of the Sea gave rise to the concept of EEZs. Of the Eastern Mediterranean players, Turkey and Israel remain outside the convention, while Greece and Cyprus completed the ratification process in the mid-1990s. The EEZ provides coastal states up to a two hundred-mile zone where they enjoy sovereign right to exploit the energy and fishery resources and manage scientific research designed to improve their use as well as develop wind or wave-based energy. Otherwise, all other states have the right to innocent passage or to lay down cables or pipelines.

The convention envisages that states will negotiate mutually accepted limits where their respective EEZs overlap. The government of Cyprus has concluded three EEZ agreements with Egypt (2003), Lebanon (2007), and Israel (2010). Turkey’s position is particularly problematic. It is not a signatory to the agreement, yet interprets its self-declared EEZ as including the islands near its mainland, including Cyprus. It has also declared that it will issue permits for hydrocarbon exploration in what are Greek and Cypriot EEZs. It is thus at odds with the mainstream views and practices of the international community.

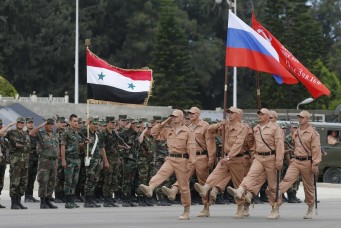

The 2019 Turkish–Libyan deal delineating the boundaries between the two countries took all in the region by surprise. The agreement with Turkey was signed by the Tripoli-based, UN-recognized Libyan government, the Government of National Accord (GNA), that is embroiled in a civil war. Turkey, Qatar, and Italy are supporting the Tripoli government while the UAE, Russia, Egypt, and France have supported the rival side, the Libyan National Army (LNA) led by General Khalifa Haftar, and its civilian face, the Tobruk-based House of Representatives.

The Turkish–Libyan agreement represents another salvo by Ankara to impose its will in the Eastern Mediterranean. These actions are seen as part of a wider “Blue Homeland Doctrine,” a naval strategy developed by nationalist Turkish officers designed to assert Turkish dominance of the Eastern Mediterranean and the Black Sea. To this end, Ankara has been investing significant resources into expanding its naval forces.

The European Union has been critical of the Turkish–Libyan agreement; Italy, despite its opposition to the Haftar regime in Libya, has found it imperative to sign a maritime demarcation agreement with Greece in response to this deal. Europe has also gone on record supporting the construction of an undersea electricity cable link, the EuroAsia Interconnector, between Israel, Cyprus, and Greece, which will then connect to the European electricity grid. The electricity is to be generated from the Cypriot and Israeli gas finds.

The Politics of Discovery

The gas discoveries have accentuated existing geopolitical divisions in the region. At the center of these lies Turkey, which, under President Recep Tayyip Erdoğan’s regime, has become far more assertive, uncompromising, and oftentimes belligerent in its approach to allies and neighbors. Turkey has insisted that Cyprus ought not develop its field until such time as the division of the island is resolved. Turkey has claimed that some of the discoveries have violated its own continental shelf and the Turkish Republic of Northern Cyprus (TRNC)’s rights.

In 2018, Turkish Foreign Minister Mevlüt Çavuşoğlu condemned the 2013 Egypt–Cyprus demarcation agreement on delineating their respective EEZs, arguing that it conflicted with Turkey’s continental shelf. Ankara’s maximalist claims challenge EU-member Cyprus’ rights to its own EEZ; Ankara has even published maps that show the TRNC with an EEZ designation that is larger than that of the rest of Cyprus. The TRNC, created following the 1974 Turkish invasion of Cyprus, does not enjoy international recognition; the Republic of Cyprus, by contrast, represents the whole of the island in the eyes of the international community.

Turkey’s legal and rhetorical postures have been accompanied by demonstrations of military power. The Turkish Navy has three times flexed its muscles and taken aggressive steps against civilian ships working in the Cypriot EEZ. It challenged a Norwegian vessel searching for hydrocarbons (2014), an Italian drilling ship (2018), and an Israeli oceanographic research ship (2019), forcing them to cease activities and move out of contested maritime areas.

Turkey also claimed that its navy had prevented a Greek frigate from harassing one of its seismic vessels, a charge that the Greeks denied. In March 2019, Turkey also conducted large naval exercises simultaneously in the Black Sea, the Aegean Sea, and the Mediterranean. In addition, Ankara has deployed two drilling ships to search for gas in waters to the west and southwest of Cyprus.

Turkey has thus used hard power and coercive diplomacy to prevent the full development of the Eastern Mediterranean fields. Its attempts to assert primacy or at least a veto over the plans of its smaller neighbors reflect the volatile and uncertain political environment. It is useful to consider the larger context of this complicated web of bilateral relationships.

Turkey–Egypt

Turkey had hoped that the Arab Spring would bring about a new era in Turkish relations with newly opened Arab states. Yet, Erdoğan and his foreign ministry were left deeply disappointed by the final outcome of the upheavals. Nowhere was this disappointment felt more acutely than with Egypt, where the short-lived solidarity between Ankara and a Muslim Brotherhood-led government in 2012–2013 was quashed by the Egyptian military’s ousting of President Mohamed Morsi and the establishment of the current government of President Abdel Fattah El-Sisi in 2014. Erdoğan has been harsh in his disdain for Sisi, going so far as to say, “I will never talk to someone like him.” This tension has exposed a new regional fault line, with the Gulf Arab states enthusiastically supporting Egypt.

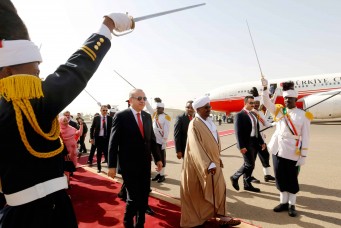

Egyptian leaders, for their part, have been worried about Turkey’s construction of naval bases in the Red Sea, which could embolden Sudan to revive its territorial dispute with Egypt, specifically over the disputed Halayeb Triangle. Micha’el Tanchum compares Turkey’s build-up of bases in the Red Sea and Persian Gulf to China’s “String of Pearls.”

The desire to expand Turkey’s naval presence throughout the region corresponds with the Blue Homeland Doctrine mentioned earlier. In fact, from early on in Erdoğan’s rule, his party, the Justice and Development Party or AKP, initiated a $3 billion “National Warship” program. Erdoğan at the commissioning ceremony of the first such vessel declared his naval ambitions by stating that Turkey’s national interests are “residing in the Suez Canal, the adjacent seas, and from there extending to the Indian Ocean”. Such statements over the years have not been reassuring to Cairo.

Turkey–Israel

After the rise to power of Erdoğan and his Justice and Development Party, both Turkey and Israel worked to maintain an element of the strategic cooperation that had marked the relations between the two during the 1990s. The carefully calibrated Turkish–Israeli relationship took a sharply negative turn in 2010 when the Mavi Marmara—a ship chartered by a hardline Turkish Islamic charity bringing relief supplies to besieged Gaza—was boarded by Israeli troops. The incident resulted in the death of ten Turkish nationals, and it took some six years for the two countries to try resuming normal ties. Erdoğan’s championing of the Palestinian issue, his bid for leadership of the Islamic world, and the interplay between these and domestic politics was perhaps the most important influence on the relationship. Therefore, no amount of compensation or regrets by Prime Minister Benjamin Netanyahu would prevent the hardening of Turkish attitudes toward Israel, nor restore Israel’s confidence that Turkey could be a reliable partner. Turkey pulled out its ambassador from Israel in 2018, paradoxically not for anything for which it could blame Israel, but simply because U.S. President Donald Trump decided to recognize Jerusalem as Israel’s capital.

Despite mistrust and a ten-year-long political divide, Israeli–Turkish trade relations have remained steady and even improved. Trade volume increased from $3.4 billion in 2008 to $5.6 billion in 2019. The declining trend in Israeli tourists going to Turkey has, starting in 2019, been reversed. Paradoxically, this uptick in tourism has occurred in tandem with Israel Defense Forces (IDF)—for the first time—stating that the IDF now has, “included the aggressive regional policies of Turkish President Recep Tayyip Erdoğan as a top danger to watch.”

Turkey–Libya

The Turkish–Libyan maritime agreement has brought additional focus on Libya, which has traditionally been an important oil producer. Libya’s oil infrastructure fell on hard times at the end of the Muammar Gaddafi era and has worsened with the advent of the civil war. In spring 2020, Turkey decided to massively augment its involvement in Libya and helped the GNA deal Haftar and his LNA forces a humiliating defeat. Turkish drones and the Syrian mercenaries it brought into Libya halted and pushed back the LNA’s advance on Tripoli, capturing significant territory and arms depots in the process. Turkey has now established itself as one the major players in the Libyan war. In fact, in July 2020, it was Turkey, not the GNA, that threatened new hostilities unless Haftar’s forces voluntarily relinquished critical positions, including the strategic town of Sirte. One unintended consequence of the Turkey–Libya agreement was to strengthen the resolve of Haftar’s allies such as Egypt. It was, therefore, not surprising that Greece hosted Haftar in January 2020 and promised to block any agreement in the EU on Libya unless the Turkish–Libyan deal was scrapped.

Israel–Greece–Cyprus

In light of the tensions in the Ankara–Tel-Aviv economic and security partnership, Israel’s foreign policy has gradually moved to closer ties with Greece and Cyprus. The energy finds greatly validated and revitalized those relationships, and the creation of the EMGF signals a deeper political commitment by the parties to work together. Israel may not necessarily view its relationship with Turkey as a zero-sum one, but at present it has deepened ties with Cyprus and Greece at Ankara’s expense.

Israel–Egypt

Cooperation over the natural gas discoveries is a boon to Israeli–Egyptian relations. After a long cold peace, during which the 1981 treaty relationship was observed by the letter but not always in spirit, more recent governments in Cairo and Tel Aviv have found pragmatic ways to cooperate, over security issues in Gaza and the Sinai, and now over shared economic interests. Israel is already exporting gas to Egypt. Israel also sees opportunities to improve its economic relationship with Jordan, and possibly Lebanon, through the gas pipeline business. It builds on long-held beliefs that economic interactions can build greater trust and good will among parties, even when the Palestine question is far from resolution and many disagreements in Israel–Arab relations persist.

The Larger Geopolitical Picture

At the present time, events regarding the new energy resources of the Eastern Mediterranean are moving in favor of the Israel–Greece–Cyprus–Egypt coalition. As of mid-2020, Turkey is the outlier, attempting to limit if not undermine any new multilateral regional institution if such an organization’s structure does not conform with its assertions of its rights on the continental shelf. This has created an environment of uncertainty and tension about the Eastern Mediterranean, rather than the much-touted opportunity for energy interests to be drivers of regional peace and conflict resolution.

The establishment of the EMGF, nonetheless, is a major achievement. While the new multilateral organization is still in its nascent stages, it has galvanized some positive political spirit among its initial members. It was launched in Athens, its headquarters will be in Cairo, and Israel is set to provide a major leadership role in its capacity as the source of much of the gas.

Turkey has not found a way to reconcile itself to this new situation. Instead, the Turkish state continues to promote controversial interpretations of international norms and laws in self-serving ways. Turkey has refused to recognize islands’ rights to their own continental shelf or other agreements signed by sovereign nations, such as the one between Egypt and Cyprus. At the same time, the Erdoğan administration insists that its recent agreement with Libya is valid and legally binding.

Key international players, including the EU and the United States, have declared their support for the EMGF and its projects. There has also been pushback against Turkey’s maritime assertions. Early in 2020, France dispatched war frigates to the Eastern Mediterranean in support of Greece against Turkey. The European Union unanimously agreed to impose sanctions on Turkey for its drilling activities in the Eastern Mediterranean.

The repercussions of this new energy picture could well reshape the geopolitical landscape in the near term. The new partnership includes NATO member Greece, EU members Greece and Cyprus, and treaty partners Israel and Egypt. It bridges well-established institutional channels to create a new cross-regional structure that deepens commercial and political ties among its founding members. Yet, whether it proves to be a driver toward a more peaceful region or another source of instability will depend on a number of factors.

Moving away from zero-sum thinking and the legacies of mistrust

Turkey today is the pivotal player in the region. With Turkey currently playing a spoiler role, is it possible to find common ground between Turkey’s important position as an energy transit state to Europe and the new EMGF? Turkey’s tendency to see the situation in black and white terms has not permitted a constructive negotiation to see if its interests can be reconciled with those of its neighbors and rivals.

The Anatolian state has long been a bridge country, linked to the Arab World by old imperial political legacies and by modern economic interdependencies. Under Erdoğan and his ambitious foreign policy, some see a neo-Ottoman desire to reassert leadership, but he has discovered that not all countries that have a robust economic relationship with Ankara will bend to his will. Erdoğan has found himself competing with increasingly confident Gulf Arab states willing to provide a counterbalance to Turkish ambitions.

The Gulf Arabs are also asserting themselves as more ambitious players, building some concentric circles of influence beyond their borders, from their roles in the Yemeni and Syrian civil wars, to the Horn of Africa, and to Libya. They may be investors in the new energy opportunities in the Eastern Mediterranean, but they are second-tier players, not drivers of the new situation. Israel, on the other hand, plays a central role as the key beneficiary of energy discoveries with its advanced economy, sophisticated industrial capacity, and political ambition to expand its partnerships in the wider region. When the discoveries were new, Israel thought there was the potential to transform regional relations. Israel envisioned pipelines feeding an LNG plant in Cyprus continuing on to Turkey. From there, Israeli gas would end up in the Europe-bound Trans-Anatolian Natural Gas Pipeline or the Trans Adriatic Pipeline, both then in their planning stages.

Israel may have also hoped to contribute to greater regional stability, should the economic shared interest nudge the parties on Cyprus to restart their negotiations. Given the emerging Turkish objections to Nicosia’s right to exploit the Aphrodite and Calypso fields, such an aspiration does not seem achievable at present. Nevertheless, Israeli Energy Minister Yuval Steinitz has been publicly open to future Turkish cooperation: “If Turkey would be interested, the door is open,” he told Reuters earlier this year.

Israelis, as Burcu Özçelik argues, have more often than not exercised a great deal of pragmatism. In this respect, the timing of the energy finds is fortuitous. Israel has enjoyed an incremental improvement in its ties to major Arab states in the past two decades and has long seen benefit in stable relations with Turkey, based on shared security interests related to terrorism and extremism and mutually beneficial trade and economic relations. The ball is in the Turkish court. Should Ankara’s current confrontational nationalistic policies, ranging from Syria to Libya, the Eastern Mediterranean, and more recently, over the Hagia Sophia becoming a mosque, backfire and negatively affect its economic and political fortunes, the Erdoğan administration may conclude that a shift in its relations with Israel would be one way to alter these dynamics.

The current COVID-19 worldwide crisis may, as Gabriel Mitchell argues, prove to be a turning point as it could compel the would-be gas exporters to recalibrate their goals so as to focus on more manageable domestic and regional objectives. The recession-driven declining demand for gas in general and the $7 billion price tag for the pipeline have together undercut much of the impetus forward. Turkey will for the considerable future be suffering from the effects of the pandemic and, therefore, may have to alter its approach to the region.

The EMGF becoming a more effective institution than others in the region

It has long been said that the Middle East lacks strong regional institutions. The Arab League’s stature in setting the regional agenda or defining common interests in the Arab World has diminished, and the current rift among Gulf states that has spilled over to the civil wars in Syria and Libya has weakened the Arab League further. The Gulf Cooperation Council, once expected to evolve into deeper integration of the Gulf states, has faltered over the rift between Qatar and its neighbors. More recently, different configurations of temporary alliances have become the norm, rather than the formal, consensus-based positions of the past. As Barcelona scholar Eduard Soler has described it, the Syrian war has demonstrated a new form of cooperation he calls liquid alliances, temporary and contingent forms of collaboration among regional states.

In theory, the new EMGF promises to be more than a liquid alliance. Its strength will reside in its core mission to manage a commercial network that represents significant economic gains for all members. It remains to be seen if the EMGF will develop smart ways of doing business and not become overly formal and bureaucratic. The hope is that the states and the private sector corporate stakeholders will demand that the forum be a modern, agile, technologically advanced organization that serves the interests of its members.

How chronic Middle East fault lines affect the prospects for success

The political divide between Turkey and Egypt reflects the deep and existential issue of the role of Islam in modern Middle Eastern politics. Egypt has taken measures to pressure and curb the proliferation of political Islam. They have taken a firm stand, perhaps from the hard knocks of September 11, 2001 and the Arab Spring, against the Muslim Brotherhood and any organized Islamic movements that challenge the governance and power structures of incumbent regimes. In this view, while the Muslim Brothers may have eschewed violence in pursuit of their political objectives, any political group invoking Islam is on a dangerous path that could lead to extremism.

Turkey is on the other side of this divide. While Erdoğan may adhere to the secular tenets of the Turkish constitution, his Justice and Development Party is affiliated with the Muslim Brotherhood, and as such, is anathema to Egypt and the powerful Gulf states that now promote a clear separation between the functions of a modern state and the private religious lives of citizens. This present geopolitical reality is deeply ironic. For much of the twentieth century, Turkey was a militantly secular state while Saudi Arabia was created out of an alliance between the Wahabi religious establishment and the Al-Saud tribal dynasty. Now the tables have turned, and the roles reversed.

Moving Ahead with the EMGF?

The likelihood that the EMGF will usher in an enduring transformation of regional politics is low, but still worth considering. A pragmatic, mutually beneficial network of public and private interests should build political good will that could be channeled into larger gains over time. An ongoing collaboration between two or more EU members and Israel and Egypt helps reconceptualize the Eastern Mediterranean. Such an approach will make geographic and economic interests more important than the frozen political alignments of the past. In a best-case scenario, a successful EMGF could create momentum for resolving the division of Cyprus, for normalizing Israel–Palestine economic relations as a precondition for political accommodation, and for overcoming the split between Turkey and key Arab Sunni states over regional hotspots in Syria and Libya in particular. Each of these steps would be a remarkable achievement.

The more likely near-term outcome is continued but manageable tensions without outright conflict between Turkey and the EMGF states. The gas developments are moving forward, and more states may join the forum. This near-term outcome is more likely if a global economic recession caused by the coronavirus pandemic arrests or slows down the EMGF’s investment goals, but the underlying logic of the forum is likely to propel the project forward, perhaps on a slower timetable. Turkey may continue to put roadblocks in the way, but may not be able to overcome this multilateral enterprise. Ankara will need to weigh the cumulative costs of being the outlier in the emerging political economy of the region.

A worst-case scenario relates to a further hardening of the Turkish position, and an escalation of its coercive moves to block the development of new pipelines. Turkey’s proud and stubborn leader could find himself cornered, trapped by his own rhetoric. A case in point is the declared Turkish intention of drilling in waters next to Crete and Rhodes, which Ankara claims is its right in the context of its deal with Libya. Conflicts can be triggered by such miscalculations or unwillingness to find compromises.

Today, armed conflict between Turkey and its neighbors in the Eastern Mediterranean seems a remote possibility, but it cannot be ruled out. Accidents, especially at sea, do occur. Yet, this possibility provides Greece, Cyprus, Israel, and Egypt with all the more reason to work with Turkey, if possible, and spread the EMGF’s relationships to Europe and beyond.