Will Lebanon and Israel Finally End their Maritime Border Dispute?

Israel and Lebanon seem on the verge of a deal that is expected to settle their maritime border dispute, which could lead to securing their energy resources

London-based Energean’s drill ship begins drilling at the Karish natural gas field offshore Israel in the east Mediterranean May 9, 2022. Ari Rabinovitch/Reuters

Perhaps now more than ever, a looming American-led effort to settle the maritime border dispute between Lebanon and Israel seems within reach. If proven successful, such a development could be a game-changer for both nations, who have been in a state of war for seven decades. Conflict between both countries escalated forty years ago when Israel invaded Lebanon in 1982.

In 2020, the United States resumed its decade-long mediation demarche between Tel Aviv and Beirut regarding their maritime borders. This negotiation track is apparently making headway as it entered its final stages over the past few weeks. The significance of an Israeli–Lebanese maritime agreement would not only be limited to mere economic benefits—which largely pertain to the allocation of gas reserves to each of the two states, paving the way for the much-needed gas exports from the Eastern-Mediterranean waters to Europe. Equally important are the geopolitical repercussions that might be unleashed by such a deal, especially when it comes to the prospects of averting future conflict between Israel and the Iranian-backed militant Shiite group, Hezbollah.

In light of the blend of interests strategically at stake not only for the trio (Lebanon, Israel, and the United States) directly involved in this process, but also for the European Union which is already in dire need of diverse energy resources to lessen its reliance on Russian supplies, it can be fairly said that hammering an Israeli–Lebanese agreement on maritime borders has become much more a matter of “when” rather than “if”.

Chronology of the Lebanon-Israel Maritime Dispute

When the United Nations identified the “blue line” as a sort of provisional separation —not a formal boundary—between the Lebanese and Israeli territories after the latter’s withdrawal from south Lebanon in May 2000, the specific issue of maritime borders between the two countries had not yet surfaced. Back then, Hezbollah—supported by Damascus—focused its rhetoric on disputed land borders, namely the Shebaa farms. Successive governments in Beirut have claimed the farms to be “occupied Lebanese territory” although they had been originally seized by Israel as part of Syria’s Golan heights during the 1967 war.

It was a few years later that the issue of maritime borders started to grab the attention of some regional countries amidst the rise of gas and oil discoveries in the Eastern-Mediterranean. At the time, experts began unveiling projections surrounding the vast reserves of natural wealth lying beneath the Levant Basin; perhaps the most prominent among these estimates was one published by the U.S. Geological Survey in 2010, which indicated that unexplored potential reserves may reach 122 trillion cubic feet (tcf) of recoverable gas in the East-Mediterranean waters, specifically in the subsea and coastal geological region shared by Cyprus, Israel, Gaza, Lebanon, and Syria.

Those findings prompted a handful of regional countries to explore the prospects of their hidden marine resources. Over nearly two decades, Israel expedited plans for discovering major gas fields in its waters, such as Tamar and the Leviathan, as was the case in Egypt and Cyprus. Unfortunately, Lebanon at the time did not capitalize on its alleged newly found treasure.

The Unfolding of the Dispute

In January 2007, a maritime delimitation agreement was reached between Lebanon and Cyprus. However, numerous question marks were raised about the substance and timing of that accord, which was signed more than two years prior to when Lebanon’s Exclusive Economic Zone “EEZ” was officially defined. (EEZ is the area in which a given country is legally eligible to make use of its marine resources). It was not until April 2009 that Point “23” was identified as the southernmost point of Lebanon’s EEZ, not Point “1” as the Lebanese side itself had mistakenly stipulated in its maritime deal with Cyprus.

The Lebanon–Cyprus deal never entered into force because it was not ratified by the Lebanese parliament, partly due to pressure from Turkey, which denounced all maritime border accords involving the Republic of Cyprus. Subsequently, Israel and Cyprus signed their own maritime delimitation agreement in December 2010 (which entered into force in February 2011) by which Tel Aviv ignored the updated Lebanese identification of the latter’s EEZ. This meant that Israel did not recognize Point “23” as Lebanon’s southernmost tip although such a coordinate line had been submitted by the Lebanese mission to the UN a few months earlier in July and October 2010.

Rather, the maritime deal between Israel and Cyprus specified Point “1” as Israel’s northernmost marker—seventeen km north of Point “23”. This view was later adopted by Benjamin Netanyahu’s cabinet, and then officially delivered to the UN via the Israeli mission there in July 2011. This prompted Lebanon to resubmit its counter-perspective to the UN in November 2011, restating Point “23” as its boundary.

The Israeli-Cypriot agreement, likewise the Lebanese–Cyprus deal, included a standard clause specifying that the geographical coordinates of the first and last markers may be adjusted in light of future EEZ delimitation-demarcation with other neighboring states. This actually left open room for future maneuvers by the Israeli and Lebanese sides.

The Long Journey of U.S. Mediation

Due to the official state of war between Lebanon and Israel, a third-party mediation was the apparent option for peacefully settling their maritime dispute. The initial Lebanese preference was to stick to the UN as the main interlocutor. However, that was not feasible at least from a legal standpoint because Israel is not party to the 1982 United Nations Convention on the Law of the Sea (UNCLOS), apart from the historical tendency of the Israeli establishment to undermine the UN by mocking it as an acronym for “United Nothing”. Therefore, the only logical mediator had to be the United States.

Back in 2011-2012, Hezbollah seemingly accepted the Lebanese government’s engagement in the American-led talks. That was partially triggered by the Obama administration’s preliminary steps aiming to adopt a conciliatory tone toward Iran, Hezbollah’s patron, in an effort to resolve the nuclear issue. Nonetheless, Hezbollah was still deeply entrenched in Bashar Al-Assad’s armed campaign at the onset phase of Syria’s civil war.

At the time, Frederic Hof was the first U.S.mediator assigned to resolving the Israeli-Lebanese maritime border dispute. He was considered then to be among Washington’s prominent specialists on the region as he had been previously assigned by the Obama administration—before the “Arab Spring”—to broker a peace treaty between Israel and Syria, which reflected a strategic goal by the U.S and its regional allies to reorient Demascus away from Tehran, in exchange for a phased Israeli withdrawal from the Golan Heights. Despite the initial progress he reportedly achieved, Hof’s mediation mission between Israel and Syria eventually crumbled soon after the outbreak of the Syrian uprising in March 2011.

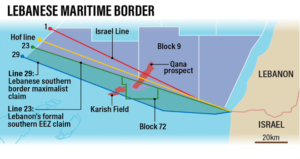

A few months later, he was assigned to his next mediation role, but this time to broker a deal between Beirut and Tel Aviv. Following the failed talks with the Syrians, Hof was already negatively perceived by Hezbollah due to his anti-Assad stances. That was possibly one reason behind the eventual failure of the Lebanese–Israeli track back then. In terms of the details of the mediation, Hof had proposed, in May 2012, a plan to create a provisional but legally binding maritime line. The so-called “Hof line” would have granted Israel slightly more than 40 percent of the disputed area between Points “1” and “23” (370 out of 860 square kilometers), while allocating around 57 percent to Lebanon.

After Hof’s failure and departure, Amos Hochstein, an Israeli-born American diplomat and energy expert, took over this mission during Obama’s second term. Hochstein proposed in 2013 to draw a maritime “blue line” resembling the one established by the UN in 2000 to demarcate the Lebanese-Israeli land border. The “new” line was supposed to be temporary with the aim of mitigating frictions by prohibiting any exploration activities within the disputed area until a solution was reached. It was seen as a good starting point in Lebanon, but was not well-viewed in Israel. Continued power vacuums in Lebanon also did not help move the proposal forward. By the time Lebanon had functioning institutions, with the election of Michel Aoun (an ally of Hezbollah) as president and forming a new cabinet in the last weeks of 2016, the Obama administration was already becoming a “lame-duck” after the election of Donald Trump.

Resolving the Lebanese–Israeli maritime dispute was not a genuine priority for Trump who was inclined to view Lebanon only through the prism of reducing Hezbollah’s influence as one of Iran’s proxies. In turn, Hezbollah was adamant not to ease the situation for an American administration seen as having adopted the most hardline position against Tehran and its regional allies since the 1979 Revolution.

However, the last year of Trump’s era coincided with an alarming set of gloomy events in Lebanon: an economy on the brink of bankruptcy, longer power outages, widespread protests reflecting deep public frustration toward the ruling elite, and a port explosion. Such a terrible downturn forced Hezbollah and its internal partners to cope with Washington’s renewed demarche through which the then-American envoy, David Shenker, tried to revive negotiations just a few months before the 2020 U.S. presidential elections. The timing back-then was prompted by Trump’s desire to attract more Israeli-leaning voters for his re-election.

Consequently, a new round of American-mediated talks between Israel and Lebanon resumed in October 2020 (with the UN confined to a secondary role), but it was only few weeks later that the Trump era practically came to an end in the wake of Joe Biden’s victory in the U.S. presidential elections, November 2020.

Hochstein “2.0”

Hochstein was re-chosen by the Biden administration as the U.S mediator. Since he was already a well-known figure to Israeli and Lebanese interlocutors, perhaps he was expecting or at least willing to resume negotiations from the point where he left in late 2016. However, he found the Lebanese negotiating ceiling in 2021 to be significantly different as Lebanese negotiators claimed Line “29” as the country’s southernmost maritime point, allegedly adding another 1,430 square kilometers to its exclusive economic zone, including part of the Karish gas field totally claimed by Israel.

Lebanon’s new demand was reportedly influenced by a technical survey conducted some years earlier by a group of army specialists with the assistance of the UK Hydrographic office. In turn, the Israeli side and even Hochstein himself strictly dealt with such an upgraded ceiling as a “non-starter”.

Since the beginning of this year, and as the Ukrainian crisis gradually shifted to the brink of a fully-fledged Russian armed conflict, the West has become increasingly alert to the strategic necessity of diversifying Europe’s energy supplies. Perhaps that’s why Hochstein ramped up his shuttle diplomacy between Beirut and Tel Aviv in February 2022, just a couple of weeks before Moscow’s invasion of Ukraine.

Nevertheless, tensions in the East-Med seemed to be mounting last June when Israel moved a gas storage and offloading vessel (affiliated with the Greek-owned, London-based gas company “Energean”) onto the Karish field. In response, Lebanon’s leaders submitted to Hochstein an updated counter-proposal which included a swap compromise: they would move back to Line “23” on the condition of acquiring the entire Qana field whose further southern edge lies beyond the mentioned line. (As shown in the illustration below, Qana field mostly lies in the Lebanese claimed Block 9 where gas discoveries have not been yet made, while a small portion of that field lies within the Israeli claimed Block 72). In return, Lebanon, as the new proposal stipulated, would drop its claim to the whole Karish field.

However, the following July, Hezbollah sent unarmed drones to the Karish gas rig without shooting it, while Hassan Nasrallah continuously threatened to target such infrastructure if Israel carried on its plans to explore gas from Karish before reaching a prior compromise with Lebanon. The situation appears to have de-escalated when Hochstein delivered positive news while visiting Beirut in late July; local media reported that Israel would be ready to cede the totality of Qana field. In exchange, part of the financial proceeds from gas or oil reserves, if they were to be found there in commercial quantities, would be paid to Israel mainly through major foreign companies—like the French “Total”—that would supposedly launch their drilling activities in Qana after the conclusion of the prospective deal.

Amid the growing momentum, Hochstein visited Lebanon on September 9, where he reportedly conveyed Israel’s willingness to demarcate the coordinates of Line “1” in a way that permits creating a limited buffer zone along the borders. While Beirut is essentially worried about the potential consequences on any future demarcation of land borders between the two countries, there is a sensible chance for the Lebanese side to agree to an adaptable mid-way regarding that Israeli-requested security buffer zone, which does not seem to be a “deal-breaker”.

Meanwhile, Israel postponed exploration activities in Karish till October 2022, most probably until an agreement is sealed. However, the timing of the potential deal coincides with two pertinent upcoming events that may influence it; the first is the end of Michel Aoun’s presidential rule in Lebanon on October 31, on the eve of the upcoming Israeli elections scheduled for November 1.

The main hurdle to clinching the deal now revolves around the pressing domestic politics in both Tel Aviv and Beirut. On the Israeli side, it may seem difficult for the current Prime Minister Yair Lapid to strike a deal with Lebanon—and indirectly with Hezbollah—at such a critical juncture; particularly in terms of how his government can address the legal argument recently raised by some opposition figures who claim that the potential draft agreement must be approved either by a public referendum or a majority of eighty Knesset members. In Lebanon, Aoun is known to have lots of political opponents across the spectrum, some of whom are influential figures within the ruling elite who do not want to lend any sort of political capital to a president who is presumably in the process of exiting office.

In the meantime, Hochstein seems to be going the extra mile in the last few days to ensure that nothing delays the opportunity of concluding an agreement, especially if Netanyahu returns to power after the Israeli elections. That’s why Hochstein expedited his shuttle diplomacy between Lebanese and Israeli officials, but this time on the sidelines of the annual UN General Assembly high-level sessions in New York.

The Dispute Through Hezbollah’s Lens

Regardless of its seemingly escalating rhetoric from time to time, it is important to realize that Hezbollah’s position vis-a-vis this specific issue has been recently driven by “realpolitik” due to the country’s severe economic crisis. Actually, the calculated surge in Nasrallah’s public threats (to target Israel’s gas installations in Karish) during the outgoing summer was largely meant to propagate a public sentiment of gratitude among ordinary Lebanese citizens who should be—from Nasrallah’s perspective—crediting Hezbollah’s intransigence on the issue. The idea is that without Hezbollah, Lebanon wouldn’t be capable of reaching a fairly solid deal with Israel.

Some analysts believe that Hezbollah’s rising involvement in setting-up the daily governmental agenda has led to a growing sense of responsibility among its rank and file. While this may have pushed Hezbollah’s leadership to acknowledge the necessity of addressing at least some of the Lebanese state’s national priorities, there are other commentators who argue that Hezbollah expects to earn some of the dividends from gas extraction and production. This is especially due to the fact that the organization has been suffering financial hardship since its involvement in the Syrian war, besides reeling from international sanctions still imposed on Iran, as well as US sanctions against Hezbollah itself.

Hezbollah also realizes the numerous impediments hindering Lebanon’s capacity to develop its own natural gas industry, which has been lagging behind for more than a decade as the country plunged into vicious cycles of quasi-collapsing economy, recurrent institutional vacuums, and Hezbollah’s entanglement in regional conflicts.

On the other hand, it cannot be denied that the maritime dispute with Israel is still the major reason that led a consortium of reputable foreign oil companies—notably “Total” and the Italian “Eni”—to occasionally lobby for reaching a Lebanese/Israeli agreement, as a prerequisite that will enable them to freely operate in the in the Lebanese Blocks adjacent to the Israeli waters. The obvious example is Block “9” where the mentioned consortium has acquired exploration and drilling rights via a tender called by the Lebanese government in 2017, but where operations remain suspended despite the fact that Block “9” includes only eight percent of the disputed area with Israel.

The Way Forward and Regional Implications

Both Israel and Lebanon have a mutual interest in resolving their maritime border dispute. Tel Aviv is keen to earn a significant portion of gas exports to Europe in conjunction with the steady hike in global demand after the Russian invasion of Ukraine. That orientation was clearly reflected by the EU deal with Israel and Egypt in June 2022.

In parallel, Lebanon’s top politicians are trying to win back public support. By adopting a populist rhetoric that generally overestimates the economic dividends of natural gas exploration, although it is still by far a non-revenue-generating sector. It is worth acknowledging that while the likelihood of an imminent deal with Israel is on the rise—and even if this development expedited the process by which the “Total-Eni” consortium would immediately resume its drilling in the Lebanese waters—experts believe that it will likely take at least five to seven years to ascertain whether there are sufficient amounts of gas reserves for commercial use.

Moreover, if such a promising stage is to be reached in the medium-long run, another sensitive decision has to be prepared in advance regarding which routes and transfer-mechanisms will be eventually chosen to export presumably Lebanese gas to Europe. Currently, there are two main alternatives: either utilizing Egypt’s liquefaction facilities as a hub for exporting regional gas (including Lebanon’s) by tankers to European ports, and/or establishing a relatively short pipeline that would connect to Europe via Turkey.

Aside from the economic benefits, the geopolitical implications of a maritime border agreement between Israel and Lebanon should never be underestimated. Ostensibly, it is true that such a deal—if concluded—would be far from being a formal peace treaty, bearing in mind that not only Hezbollah but also a considerable segment of the Lebanese public still reject or do not feel at ease about the idea of normalizing relations with Israel. Against this backdrop, official sources in Beirut lately excluded the option of any ceremonial event in which Lebanese and Israeli representatives can be gathered for signing the prospective deal. Instead, these sources believe that each side would unilaterally notify the UN with the agreed-upon maritime coordinates.

However, it won’t be an overstatement to consider the agreement as a de-facto termination of the state of war between the two nations, as it will most probably create a sensible incentive for Hezbollah to further maintain calm along the borders which have been relatively quiet since the adoption of UN Resolution “1701” after the 2006 war. In addition, the final deal may stipulate the possibility of locating the Israeli and Lebanese gas platforms within a short distance from each other, thus making it practically harder for Hezbollah to target Israel’s offshore interests in the future.

Perhaps more significantly, an upcoming trajectory of that sort will reignite the on/off controversy around the projected role of the still heavily armed Hezbollah, whether inside Lebanon or on regional matters extending beyond Israel. It will be intriguing to find out whether any sort of a deal between Lebanon and Israel will affect the political calculus not only in the case of the latter, but also in core Gulf states—notably Saudi Arabia and UAE—which already share the view that Hezbollah remains the forefront of Iran’s regional proxies.

Hence a big question may eventually loom as to whether future perspectives in Riyadh and/or Abu Dhabi would be slightly modified if it turned out that Hezbollah’s relative flexibility vis-a-vis the maritime deal with Israel is emanating from a broader aim to significantly ease its financial burdens. Will that translate in toning down its escalatory adventures at least in Yemen and some of the GCC countries? Accordingly, can we consider the “Baghdad dialogue” convened between the Iranians and the Saudis during the last few months an indicator for such a potential trajectory?

While the deal taking shape between Tel Aviv and Beirut seems incomparable with the likes of the 1978 Camp David Accords and the 2020 Abraham Accords, it could also be depicted as a “turning point” not only when it comes to the future dynamics along the borders between Israel and one of its neighboring countries, but also the potential gradual de-escalation of Hezbollah’s rhetoric and interventions in the Arabian Peninsula.

Mohamed O. Abd El-Aziz is a specialist on the political economy of the Levant countries, and is currently a graduate fellow of International Affairs at the Lebanese American University in Beirut. He has almost two decades of diplomatic postings in the Middle East and Europe.

Read More